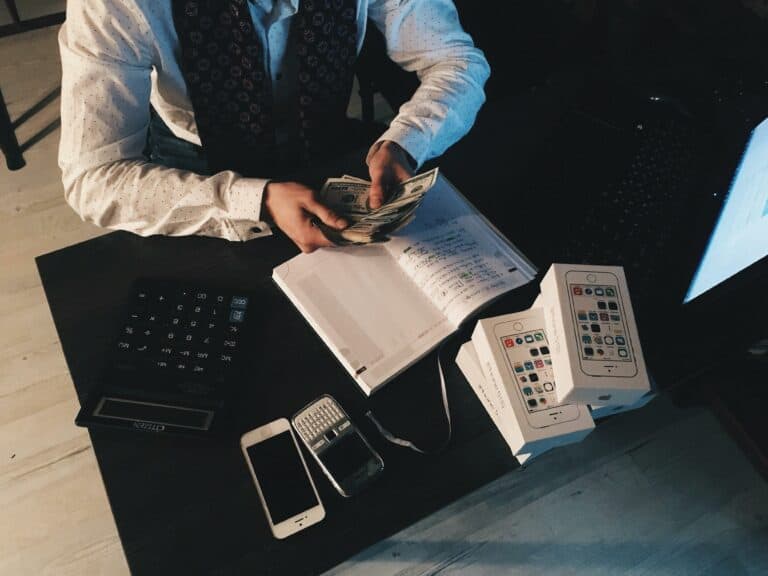

Selling a business is a big decision, and well-maintained financial records are crucial to attracting buyers and maximizing your sale price. This cannot be understated because buyers will question numbers. So, here are some recommendations on how to get your books in tip-top shape:

- Clean Up Your Chart of Accounts: Ensure all income and expenses are categorized accurately and consistently.

- Reconcile Accounts Regularly: Regularly reconcile bank statements, credit card statements, and inventory to eliminate discrepancies.

- Document Everything: Maintain clear records of all business transactions, including invoices, receipts, and contracts.

- Depreciate Assets Accurately: Depreciate assets according to accepted accounting principles to reflect their true value.

- Address Past Inconsistencies: If there are historical bookkeeping issues, work with an accountant to rectify them transparently.

- Utilize Accounting Software: Invest in user-friendly accounting software to streamline record keeping and generate accurate financial reports.

Remember, clean and transparent financial records build trust with potential buyers and make the due diligence process smoother, ultimately leading to a faster and more profitable sale.

Bonus Tip: Consider seeking help from a professional accountant experienced in preparing businesses for sale. They can ensure your books are investor-ready and maximize your business’s value.